Conservation covenants for investors

19 June 2023How a legal innovation could unlock nature markets for green finance

Developers, companies and funds are queuing up to invest in the countryside. They want to do (or be seen to do) the right thing, they want to offset their emissions and discharge their legal obligations, and sometimes they want to make money through owning environmental assets that may increase in value. In the UK alone, the Government expects annual private investment in nature to reach £500m a year by 2027 and more than £1bn a year by 2030, which may be a conservative estimate. Meaningful ecological change takes decades and requires large areas, but there is no consensus on how to structure investment so it is secure, future proof, government-approved and capable of binding multiple/successive landowners.

Conservation covenants (CCs) may be the answer.

What are CCs?

Introduced into law by the Environment Act 2021 (the Act), CCs are agreements (either indefinite or time-limited) between a landowner and a "responsible body" (RB) to manage land for a "conservation purpose" and for the public good. They came into law on 30 September 2022, but since the Government has not opened applications to register RBs, market participants are unable to enter into them at this stage. Further guidance on RBs is expected imminently, and presumably the Government will open applications at the same time.

Why are CCs an improvement on what is already out there?

CCs are better than the current investment options because:

- you do not need to own or lease the land, which can be expensive;

- they bind land more tightly than typical covenants - successors in title will take subject to the positive as well as negative obligations and there is no need to own neighbouring land;

- they are more robust than contracts for environmental services (natural capital agreements) because they bind the land and not just the parties (who are liable to die or become insolvent);

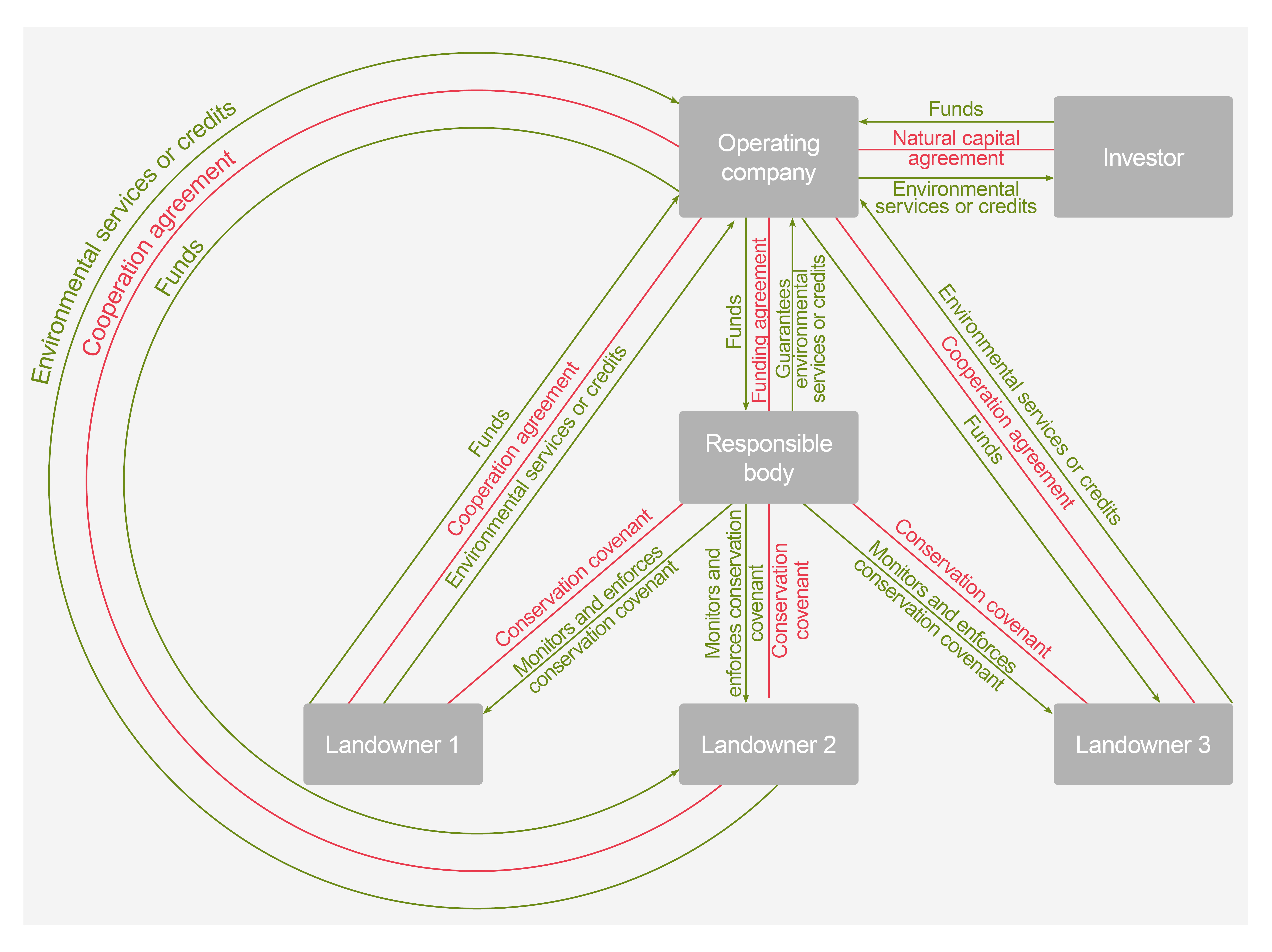

- they can efficiently hold together multiple landowners on the same (or potentially different) terms, with a single RB enforcing; and

- you can choose your own enforcing RB.

RBs are the magic ingredient. They ensure the landowner abides by the CC terms and that the environmental services provided are valid, which will give confidence to governments, investors and the market. Tax allowances and other incentives may follow.

Who can be a RB?

The RB can be a local authority, a charity or a private company. CCs are voluntary, so investors and landowners can choose their RBs. Land agents and other professional services may become RBs to serve clients. More ambitious investors might even set up their own RBs. This may be more desirable than entering into a CC with a local authority or charity, which might be inefficient or have different priorities. RBs will charge for their services and, subject to further guidance, may potentially even become revenue generators.

What can investors use CCs for?

CCs are one way to discharge the mandatory 10% biodiversity net gain (BNG) obligation on developments - another innovation under the Act that comes into force in November 2023. But BNG is only the tip of the CC iceberg. They can also be used for other credits – such as carbon or nutrient neutrality – or any environmental services, secured by a credit or not.

CCs are not limited to environmental benefits, although these are likely to be the primary purpose - they can also conserve land of historical, archaeological, artistic or community interest. For example, they could be used to guarantee access to a stone circle at the solstice, protect a local theatre from development or even preserve the Cornish dialect.

How will CC investments be structured?

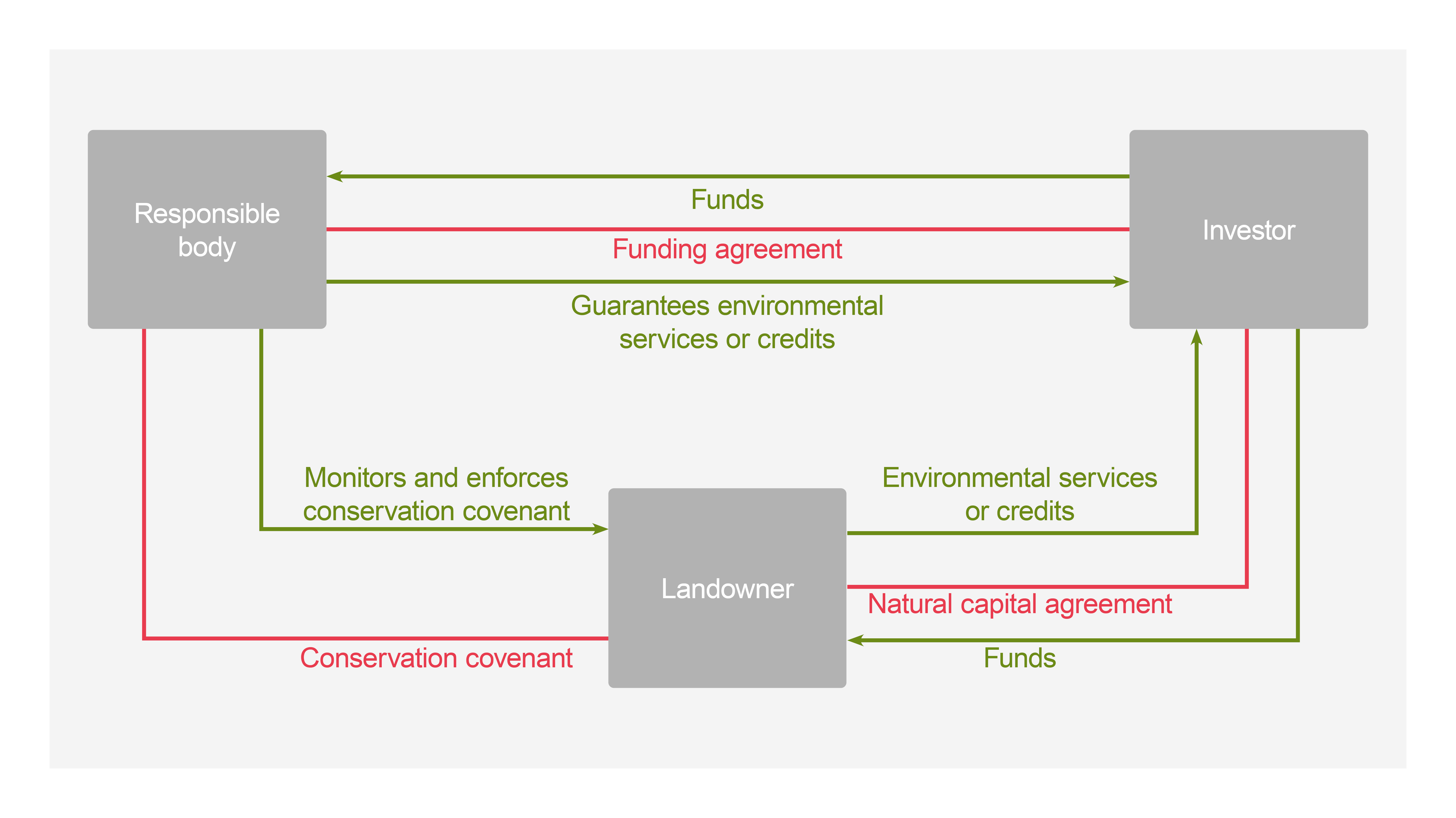

We see CCs’ primary purpose alongside natural capital agreements and part of a triangle between landowner, RB and investor. The CC between the landowner and the RB will set out the conservation purpose and bind the land. Under the linked natural capital agreement, the investor will buy environmental credits or services arising from the conservation purpose. The parties can also agree in the natural capital agreement other investor rights, for example to be closely involved in the management or a number of site visits each year with clients. The natural capital agreement can be reviewed periodically and assigned if necessary. In a third linked agreement, the investor will fund the RB to monitor and enforce the CC.

What will CCs cost?

Although substantially cheaper than owning or leasing land outright, investors will have to fund RBs to enforce and monitor CCs. A new generation of financial products will emerge to service revenue streams and long term obligations for both landowners and investors.

There is no settled price for environmental credits and services - the market is immature and values are volatile. The current price of a BNG unit is anywhere between £10,000 and £35,000. Depending on various factors relating to the land and the project, it may be possible to generate between three and ten biodiversity units per hectare. Wherever the market lands, it seems certain that large amounts of money will change hands. Consequently, investors need confidence that counterparties will be able to meet their obligations. As such, they may insist (as a condition of the natural capital agreement) that payments to landowners are staggered or protected. Existing financial products could be adapted – insurance, endowment, pensions annuity for example. RBs will need consistent funding to carry out their responsibilities.

Case studies

Case Study 1 - investor will remain closely involved with the delivery of the environmental benefits without becoming the legal owner of the land.

Case Study 2 - CCs tying together different landholdings with the same environmental objective, such as a farm cluster or group of estates to meet flood risk or water quality objectives.

Conclusion

The UK Government has committed within the 2021 Act to halt the decline in species populations by 2030 and then increase populations by at least 10% by 2042, which will require significant policy change, capital and private sector effort. CCs may be the tool to unlock the door to this nature-positive future. Financial products will need to evolve to meet these demands and, as such, asset managers and other financial services market participants have an important role to play.

With many thanks to Kate Russell of Tellus Natural Capital and David Short of Lux Nova Partners for their assistance with this article.

A version of this article was published in Estates Gazette on 17 June 2023.

Get in touch