Nature-based solutions for the real assets sector

22 February 2022Against the backdrop of COP26 and looming net zero targets, a UN report published in May 2021 stated that the world must triple its investments in nature-based solutions (NBS) by 2030 and quadruple them by 2050 in order to meet the climate change, biodiversity and land degradation targets of the three Rio Conventions.

Most current investments in NBS on a global basis, which amount to $133bn, come from public sources. In terms of regional analysis, Asian investments are estimated to value around $45 billion, the most of any single global region, with European investments in NBS totalling around $25 billion annually.

This article will seek to explore what nature-based solutions are and their application to transactions and projects in the real assets sector.

What are NBS and what is the potential for investment in NBS?

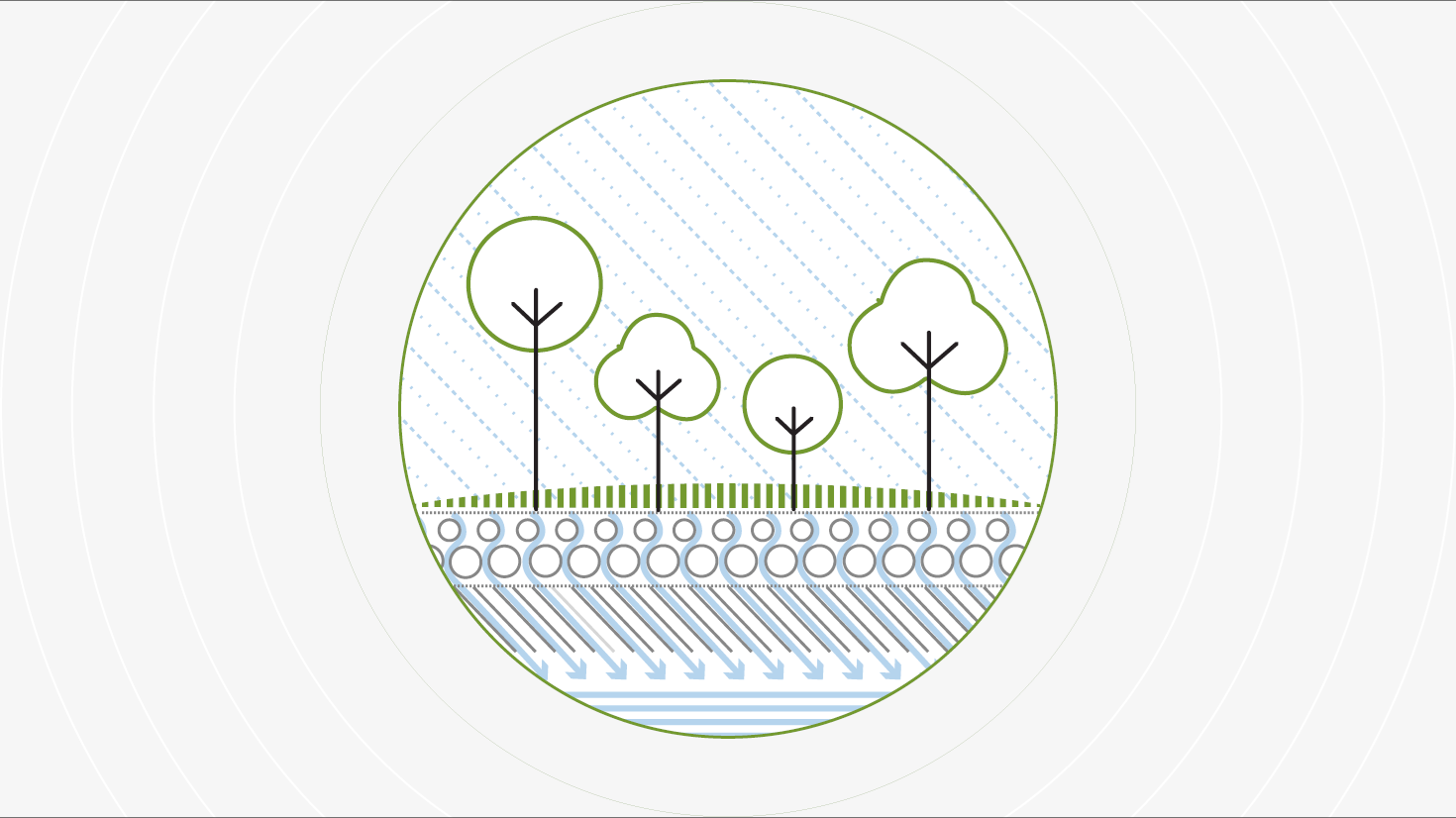

The European Commission defines NBS as "solutions that are inspired and supported by nature, which are cost-effective, simultaneously provide environmental, social and economic benefits and help build resilience. Such solutions bring more, and more diverse, nature and natural features and processes into cities, landscapes and seascapes, through locally adapted, resource-efficient and systemic interventions."

There are two main categories of NBS: existing natural capital (such as coral reefs and wetlands) and natural enhancement of environments to improve their resilience/effectiveness (for example, tree planting and shoring up of coastal regions). As a result, the main focal environments for NBS are forests, peatlands, coastal spheres, marine areas, agricultural land and urban spaces. Such projects may be on a relatively small scale - particularly in an urban context - with the use of green roofs, green walls, street trees and parks, and can range to large widescale solutions, for example restoring thousands of acres of woodland or mangrove forests. In addition to the socio-economic benefits derived from NBS projects, they provide opportunities for private sector investors to generate returns, reap the benefits of increased asset resilience and reduce operational costs. As NBS become more integrated into businesses’ operations, there will be a role for financial de-risking products such as guarantees and insurance to create attractive risk-return profiles for large, mainstream investors. The European market currently sees an approximate annual investment in NBS of $25 billion, with the majority supported by public institutions such as the European Commission and central banks, demonstrating that there is an opportunity for more businesses in the private sector to take advantage of investment in NBS.

The examples provided in this article give some idea as to the breadth which NBS encompass and the different ways in which investors and asset managers are utilising this new investment type. NBS also provide an opportunity for such investors to meet their own ESG metrics and net zero targets. We are already seeing examples in the UK institutional market of investors acquiring land to assist in meeting their own decarbonisation targets, with many investors looking to use NBS to inset carbon emissions within their own value chain alongside investments in new technologies. Scottish-based investment fund manager Par Equity and Aviva Investors have acquired more than 6,000 hectares of moorland in the Glen Dye area of Aberdeenshire, and plan to undertake extensive peatland restoration work across around 1,800 hectares of the land, and new planting of trees over around 3,000 hectares. It is estimated that the initiative has the potential to lock-up around 1.4 million tonnes of carbon, and this will form part of Aviva’s commitment to achieving net zero across the entirety of its Real Assets platform by 2040. Another such example is the acquisition by Standard Life Investments Property Income Trust of nearly 1,500 hectares of land in Cairngorms National Park in September 2021, as an investment which will offset 73% of the trust’s residual embedded and operational carbon.

This increased focus on natural capital as an investment theme is coupled with, and has been accelerated by, the Covid-19 pandemic. Particularly in urban spaces, the correlation between exposure to nature and improved physical and mental health is well documented, and with more people returning to their workplaces, exposure to nature through NBS can result in reduced staff sick leave, reduced staff turnover and an increase in worker productivity (for example, see Elzeyadi's article). The utilisation of NBS not just as an investment class but also as an opportunity to improve the environment for the wider community could tie together companies’ financial ambitions with their social responsibility.

NBS are also relevant to the Task Force on Nature-Related Financial Disclosures (TNFD), the "nature successor" to the Task Force on Climate-Related Financial Disclosures, which our corporate colleagues discussed recently in this piece. The TNFD framework aims to incorporate environmental and natural capital-related information into mainstream financial reporting. It is intended that this process, when coupled with the reporting of climate change data, will assist companies in achieving a holistic view of how climate change and natural capital can affect their performance. In turn this will inform the necessary actions that such companies could take to address the risks and opportunities identified. Indeed, one of the proposed TNFD principles is to employ an integrated approach to climate and nature-related risks, scaling-up finance for NBS.

Examples of NBS in practice

- The European Investment Bank’s Natural Capital Financing Facility (NCFF) is a flexible finance facility provided in combination with a technical assistance support facility, which provides grants for project preparation, implementation, monitoring and evaluation. Examples of projects supported by the NCFF include the Irish Sustainable Forest Fund, which focuses on sustainable forestry in Ireland run by Central Bank of Ireland, and a loan to the municipality of Athens to support the integration of green components into the restoration of public squares and streets, creating green corridors between greened areas and contributing to the natural restoration of Athens’ second landmark hill.

- EcoForests Asset Management added a new carbon capture product to its portfolio in April 2021. Natural forest regrowth has the potential to sequester up to 23% of global CO2 emissions, and forests also positively contribute to the global environment by increasing animal and plant biodiversity, watershed protection, and preventing soil erosion. As a result, companies seeking to align carbon capture commitments with broader environmental sustainability goals are finding forests an attractive solution.

- Knowledge Mile Park in Amsterdam is an example of an urban NBS, which has been created through a collaboration with a local university, 100 companies, 30,000 residents and 60,000 students. The Knowledge Mile will include two parks, 1600 square metres of green roofs and walls and vegetated areas to improve water drainage, with the overall aim of reducing air pollution caused by car traffic.

- The Ignition project in Greater Manchester has adopted urban solutions such as rain gardens, street trees, green roofs and walls and development of green spaces. These solutions should adapt to climate change impacts but also tackle socio-environmental challenges including biodiversity loss, poor air quality and the impact of pollutants on human health (for example, a study showed around 67% of the UK population are exposed to high levels of pollution that exceed WHO guidelines). This project is backed by €4.5m from the EU’s Urban Innovation Actions initiative, and brings together 12 partners from local government, universities, NGOs and business.

What are the potential challenges posed by implementing NBS?

Insurance

There is an ongoing discussion in the industry regarding the insurance of NBS, particularly for example the insuring of green walls, as these can potentially increase the risk of fire and water ingress. It may be that the approach of the industry itself can drive quality, in that insurers will only provide cover if certain standards for different types of NBS are met. Given that the use of NBS is relatively new, particularly in the private sector, it will be interesting to see how insurers decide to approach reviewing and underwriting risk in this context. Insurers are also developing products to support investors and businesses who are seeking to protect against delays to or non-completion of projects as a result of environmental impacts not yet mitigated against.

Planning

The Urban Greening Factor (UGF), as outlined in the London Plan 2021, is a planning policy deployed by the Greater London Authority to drive implementation of NBS in an urban setting. It was outlined in the London Plan 2021 (the spatial development strategy for Greater London) setting out a framework for how London will develop over the next 20-25 years. The UGF is a metric adapted from the Green Space Factor, used in cities such as Berlin and Seattle. The UGF requires new developments to include a range of urban greening measures in order to achieve a score to ensure all new developments maximise the benefits of NBS. We are yet to see how the UGF will be deployed in widescale planning applications in the UK.

One example of planning law inadvertently hindering the use of NBS is in relation to the proposed 3,700 metre squared green wall surrounding the mixed-use development at Citiscape House, along with a green roof. The design concept attained a UGF score of 1.37, far exceeding the 0.3 target for commercial property outlined in the London Plan 2021. However, these plans were amended to a student accommodation block in September 2021 partly due to changing working environments as a result of the Covid-19 pandemic. This change of use meant the original plan for a green wall was no longer feasible due to the ban on combustible materials for residential buildings above 18m. Instead, the scheme is now proposed to include a public rooftop garden with a semi-intensive green roof, a bio-solar green roof and a water garden.

However, NBS are also now being integrated into developments in order to secure substantial planning permissions. SEGRO Park in Tottenham secured planning permission in February 2021, and the site will be developed into 8 industrial units covering more than 17,000 square metres. Sitting within London’s Zone 3, it is the first industrial estate to provide a dedicated biodiverse amenity space. Living green walls, and on-site habitats for birds and insects, will cover 140 square metres and the development will deliver a 122% improvement on carbon emission, and such requirements are set out in the conditions to the permission. The development is targeting net zero in operation with energy sourced from renewables on and off site, such as photovoltaic cells (PV cells) on the roofs of each unit. The development is also future proofed with 20% of all car parking spaces reserved and equipped for electric vehicles and provisions for future conversion of another 805 spaces.

It is not only new builds that are utilising NBS; the redevelopment at 100 Liverpool Street upon completion became one of very few net-zero developments in London. To achieve this, construction works retained 50% of the existing structure so embodied carbon remained low at 390kg (well below the 2030 target of 500kg). The remaining offset focused on NBS removing carbon from residual emissions. The development has PV cells on the roof and an air conditioning system run on wastewater (also known as grey water), all helping to reduce the carbon footprint of the site.

Where do we go from here?

In respect of public policy, the Environment Bill 2021 introduces concepts such as biodiversity net gain, local nature recovery strategies, and changes to the process of environmental assessment which could provide opportunities for investment in NBS. Improvements to the planning system might also drive environmental enhancement through NBS, and on a local level, planning authorities should also be focused on how to reflect net zero and climate concerns through planning decisions and conditionality. The Environment Bill 2021, combined with NBS, will also help to contribute to the underlying portfolio investment data issues highlighted by the Sustainable Finance Disclosure Regulation (SFDR) and UK Green Taxonomy Regulation, as was recently discussed on the first episode of our "policy in practice" podcast series and also explored by colleagues in our investment management team in this recent piece.

The technological advancements behind NBS are something which economies across the world will need to harness in their drive to meet their respective COP26 objectives. Economists such as Professor Lord Nicholas Stern have always emphasised that commitments to net-zero should be based on wholesale transformations in industrial technologies such as energy alongside careful landscape management. His October 2021 working paper summarised that with the pace of falling costs of technologies like solar and wind far exceeding projections by the International Energy Agency, estimates now suggest that the cost of producing net-zero emissions by 2050 in the UK is less than 1% of the country’s GDP. As Professor Lord Nicholas states in his article, "we are going to need to understand innovation in a much deeper and stronger way, because it is at the heart of the transition to net zero."

The Chartered Institute of Building’s submission to the All-Party Parliamentary Group for excellence in the built environment in 2013 was unequivocal: "given 85% of the buildings that will be in use in 2050 already exist today, the greatest opportunity to utilise nature-based solutions and their benefits is through retrofitting". It is now down to investors, with the support of public policy makers, industry, insurers, financial institutions and others, to utilise the existing built environment to dramatically increase investment in NBS over the coming years, to meet the ambitious climate change targets set at an international level.