Tax issues on stake sales and investment into managers: structuring, pitfalls and steps to take now

Supporting Private Capital Managers

Tailored solutions for the private capital industry.

Spotlight case study

/Passle/MediaLibrary/Images/2026-01-09-17-39-34-855-69613d56d42b6e4a5841561a.jpg)

4 minute read

This article was first published by Secondaries Investor on Thursday 15 February 2024.

ECI is an acronym popular in US tax that stands for income that is effectively connected with a US trade or business - US trading income in layman's terms. Since 2017, buyers and sellers have grappled with whether ECI withholding applies on secondary transactions. GPs, on the other hand, have largely ignored or actively refused to engage with the issue. Rules that came into effect on 1 January 2023 have marked a shift in GPs' approach, leading to a significant change in both GP engagement and the risk appetite of buyers.

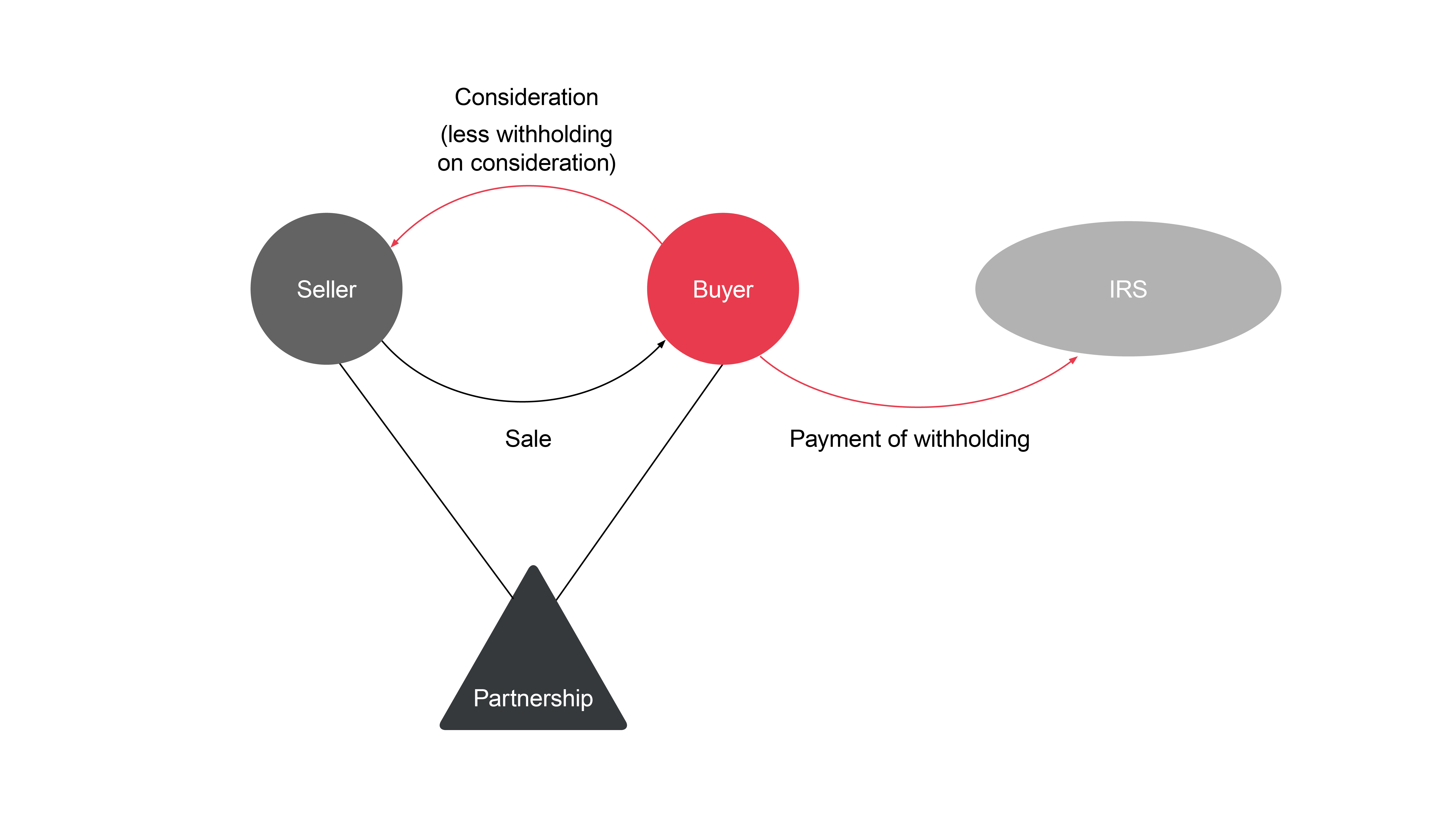

The primary rule, implemented in 2017, is that on any transfer of an interest in an entity that is treated as a partnership for US tax purposes, the buyer must withhold 10 percent-plus of the purchase price unless an exemption applies. This rule applies to all transfers in such partnerships regardless of the nexus (or lack thereof) to the US of the partnership or the transfer parties.

The only way out of this rule is for the buyer to give a certificate (fraught with procedural issues and given under pain of perjury) or to get the GP to give a certificate in each case that there is no or little ECI (within prescribed limits). GPs generally took the view they would not provide certificates and leave it to the parties to work it out for themselves.

Under the initial proposed regulations, the strictness of the rule, along with issues with the exemptions, caused sticking points on deals and sometimes led to them collapsing.

The final regulations on ECI withholding came into force in October 2020 and introduced an important "get-out" for buyers. Where the buyer established "to the satisfaction of the Commissioner that no gain on the transfer is treated as effectively connected with the conduct of a US trade or business under section 864(c)(8), no interest, penalties or addition to tax [would] apply". This resulted in buyers being able to take a commercial approach to ECI withholding risk (i.e. not withholding) where none of the exemptions applied, provided that it was clear from diligence or informal exchanges with the relevant GP that there was no ECI in the relevant fund.

Unfortunately, all good things come to an end.

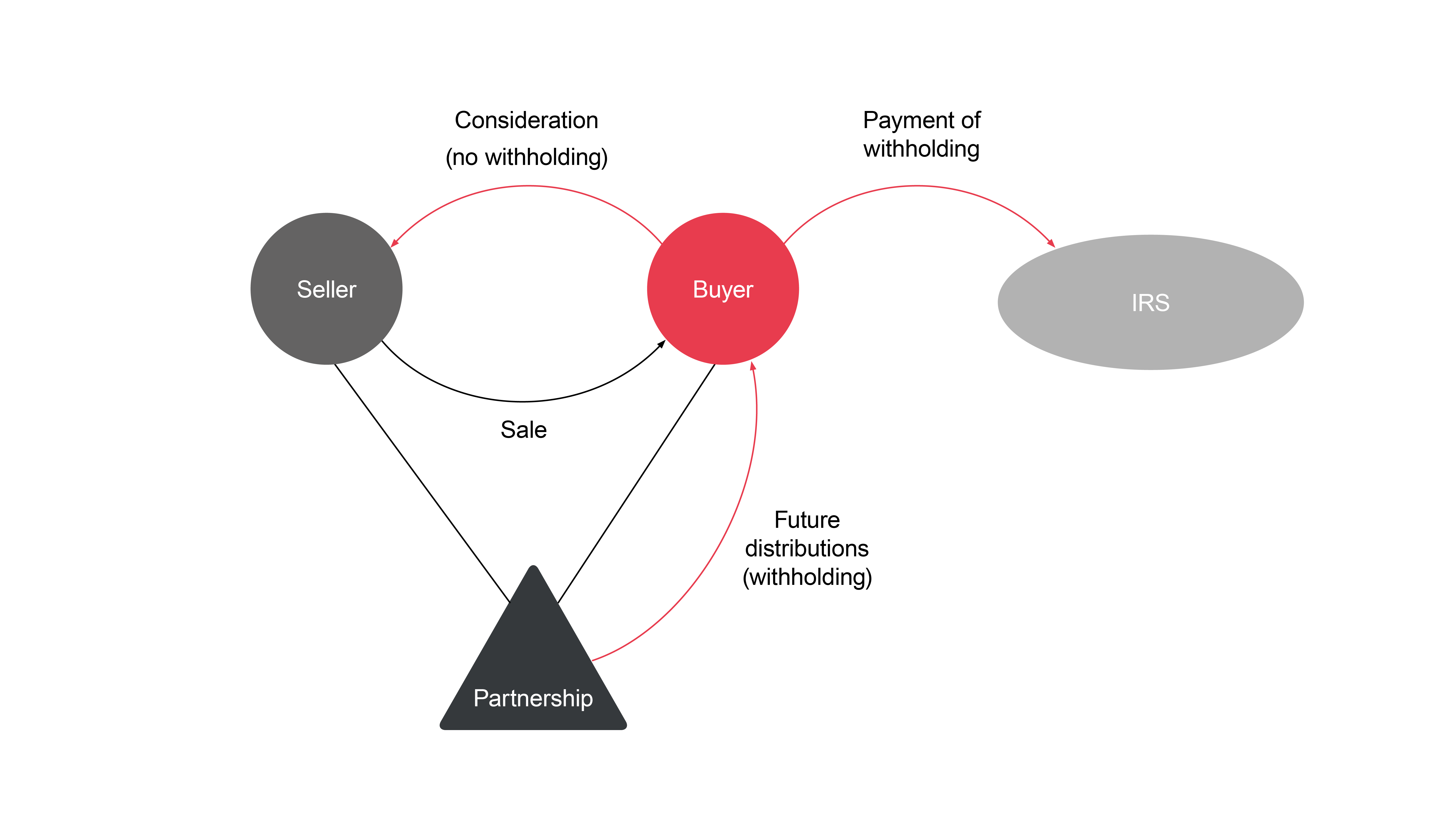

Since 1 January 2023, if the buyer fails to withhold on a transfer in a situation when ECI withholding technically applied under the rules, the partnership whose interests are being transferred will be required to withhold the under-withheld amount from future distributions to the buyer. This creates an additional burden to getting buyers comfortable not withholding - they are now concerned not only with their potential liability to the IRS but also the potential for the GP to apply withholding on future distributions to them.

The GP can protect its position under the rules by requiring the buyer to provide it with a certificate, given under pain of perjury, in which the buyer confirms that it has either withheld the correct amount or relied on a valid exemption from withholding. Unsurprisingly, most GPs have sought to put in place such processes as well as including various representations and indemnities in the transfer documentation protecting their position.

Buyers are often required to provide a certificate to the GP (as described above), in the form provided by the GP, as a condition precedent to the transfer. This means the buyer must withhold on a transfer unless an exemption applies. This has reversed the market position - buyers are no longer willing to take a view to get the transfer over the line and so ensuring an exemption applies has become paramount once again.

To finish on a happier note, the other change we have witnessed since 1 January 2023 has been a dramatic increase in the number of GPs who are prepared to provide a GP ECI certificate (one of the exemptions under the rules). This includes many European GPs who were previously unwilling to engage on the issue on the basis they did not want to muddy their hands with US tax matters. We expect this trend to continue as providing a GP ECI certificate gives the GP control of the process - the GP can ensure that the buyer has properly fulfilled its own ECI withholding obligations (not withholding on the basis of a GP ECI certificate) so that the GP is comfortable it does not have any secondary liability.

So, while the new rules on GP withholding may cause pain in the short-term, in the longer term it may lead to an easier and more standardised process around ECI withholding on secondary transfers if the trend towards GP ECI certificates continues.

Stay up to date with our latest insights, events and updates – direct to your inbox.

Browse our people by name, team or area of focus to find the expert that you need.