Private credit continuation funds: a developing frontier for secondary transactions?

29 December 2023In this article, the authors consider the use of continuation funds in private credit by comparing and contrasting their adoption with increasingly popular private equity continuation fund transactions.

Private credit – by which we mean the (direct) lending activities of alternative investment funds operating without bank intermediation – has grown markedly for years. Whilst some private credit fund managers (GPs) have performed better than others, a perception of broad success has brought increased competition (for both investors (LPs) and assets) and regulation – which GPs are navigating in addition to the prospect of more defaults, as leveraged borrowers face the economic reality of dramatically higher interest payments to service debt.

Against this backdrop, many mature private credit funds are approaching, or even exceeding, their initial terms. This presents both pressure and opportunity for GPs and their LPs to identify and implement appropriate solutions to maximise value and optimise liquidity from their portfolios.

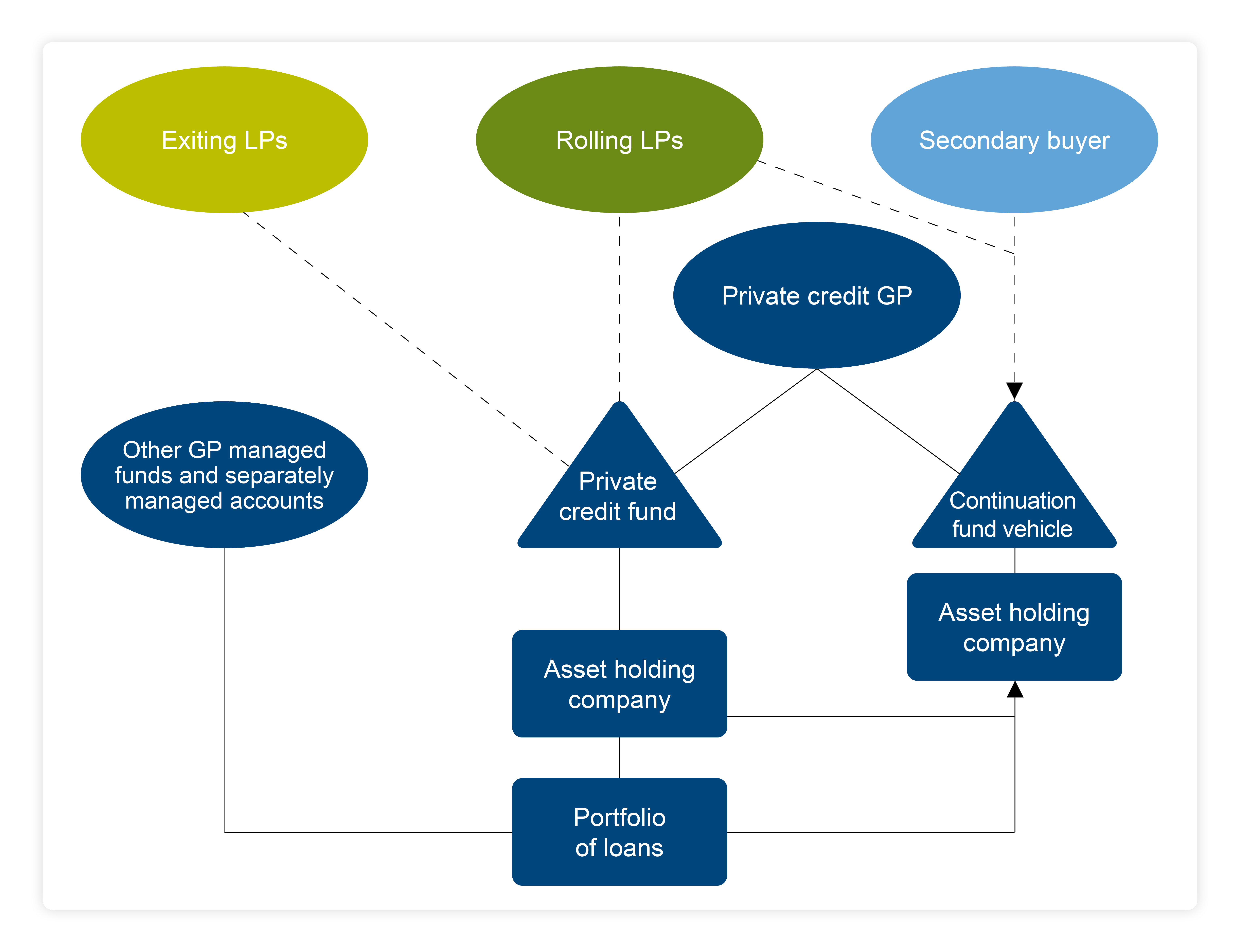

One such solution that has emerged in private equity (PE) and may gain more traction in private credit is the continuation fund. That is, a secondary transaction whereby a GP transfers a portfolio of assets from an existing fund (or, possibly, funds) to a new fund, with the participation of one or more secondary buyers who provide liquidity to the LPs of the existing fund(s) and commit new capital to the new fund. The GP typically continues to manage the portfolio under a revised fee and carried interest structure, and may also reinvest in the new vehicle by way of GP co-investment some of the carried interest (net of tax) crystallised as a result of the secondary transaction.

See the example structure in the diagram below.

Piggybacking on PE

Continuation funds have become increasingly popular in PE as offering several allied benefits to both GPs and LPs, such as:

- a more efficient and flexible alternative to traditional exits, with IPOs and trade sales often proving suboptimal in the current market environment;

- a tailored solution that can address specific needs and objectives: extending the holding period of assets, optimising capital structures, enhancing the alignment of interests of portfolio company management, fund managers and investors and facilitating succession planning; and

- optionality for LPs, which can choose between cashing out or rolling over their interests into the new fund – depending on their liquidity and return preferences.

While the PE industry has seen a surge of continuation fund transactions in recent years, the private credit industry (which, it should be said, is comparatively young) has been slower to adopt this strategy. However, this may change with several asset-specific factors that could drive demand for, and supply of, private credit continuation funds, including:

- extended timeframes to exit for PE sponsors in the current environment, and similarly difficult trading and wider economic conditions for some non-sponsored borrowers, which may result in loan terms – whether initial or as a result of extensions – increasingly stretching beyond the envisaged life span of lending credit funds to continue to support underlying businesses and assets;

- GPs’ desire to offer long-term relationships to borrowers (often developed through PE sponsors) – not least to maintain assets under management (and associated fees) when a refinancing of loan facilities via a successor fund is not feasible, and potentially also to capture the upside of any equity held alongside the primary credit investment;

- increased prevalence of stress and distress in borrowers resulting in private credit funds holding a rump of distressed debt and equity-type instruments – often at various stages of restructuring – which may require refreshed capital and patience to maximise recoveries; and

- LPs’ demands for timely return of capital (which may well be due to the "denominator effect" of declining public asset valuations requiring a reduction in investors’ private asset allocations – rather than their taking a view against private credit as an asset class); and GPs’ desire to show a track record of performance ahead of launching successor funds.

We expect that many of the features and best practices of PE continuation fund transactions will be transposed across the spectrum of private capital to their credit equivalents. Certainly, engagement and transparency with LPs (and any "LP advisory committee") in the "selling" fund(s) will be key if the GP’s straddling of the buy-side and sell-side is to be appropriately reconciled. The SEC’s recent adoption of an Adviser-Led Secondaries Rule is the latest – and perhaps firmest – indication of sensitivity to the potential for conflicts of interest when a GP instigates a transaction of this sort. By mandating that an in-scope GP commission an independent valuation of the transferring assets (and disclose any material business relationship between it and the valuer), the SEC may cement investor expectations as to how the sale process will be conducted – regardless of any jurisdiction-specific regulatory expectations that apply. And, from a squarely commercial perspective, investors may expect GPs to roll a significant portion of any crystallised carried interest into the continuation fund to demonstrate alignment to "selling" investors and secondary buyers alike. The work of the Institutional Limited Partners Association (ILPA) towards mitigating conflicts of interest in PE continuation funds will also likely be relevant to credit continuation funds.

Solving for private credit

There will, however, be some differences in carrying out a private credit continuation fund transaction. We anticipate certain issues that are more specific to the asset class, such as:

- (at least initially) a more limited number of secondary buyers with the strategy and capability to invest in credit continuation funds – this lessened competition having implications for:

- relative strength in negotiating the pricing and other terms for the portfolio sale; and

- the structure of the transaction, with a single lead secondary buyer (which may look to subsequently syndicate its investment) more likely than multiple lead buyers;

- (given lower average returns in private credit than PE) greater sensitivity of secondary buyers to the initial and ongoing costs and expenses charged to the continuation fund – requiring those costs and expenses to be clearly justified by the risk and return profile of the portfolio (admittedly, this is also a feature of primary private credit fundraising and not confined to secondary transactions);

- close attention from secondary buyers to fixed termination dates for continuation fund vehicles – it being expected that, even when taking account of the factors driving longer asset holding periods set out above, private credit investments will generally offer more certain timeframes to realisation than PE investments (with potentially punitive consequences for GPs, including carried interest step-downs and GP removal mechanisms, once limited extension rights have been exhausted);

- the dynamics and conflicts attending to valuations depending significantly on the nature and performance of the assets in the portfolio:

- valuing performing loans should be less contentious, with there perhaps also being less focus on ensuring that LPs are given the opportunity to "roll" into the continuation fund (which may be underwritten by one or a club of secondary buyers as long as the GP can demonstrate that existing loans are fairly valued and priced, having taken account of refinancing risk – a key matter for all credits in the current interest rate and wider economic climate);

- whereas we would expect there to be much more difficulty in valuing and pricing individual, and portfolios of, stressed and (certainly) distressed loans (and associated instruments), and for these to attract more specialist secondary buyers with the strategy and capability to work-out complicated portfolios alongside the GP; and

- greater complexity in deal execution which, from a structural perspective, is driven by private credit investments typically being held across a number of funds and associated separately managed account (SMA) vehicles managed by the same GP (or connected GPs) – increasing the scope for conflicts.

That structural perspective should carefully consider the tax implications of credit continuation fund transactions. Private credit funds (and associated SMAs) typically use one or more asset holding companies (AHC) to hold loans (with equity positions held at either AHC or fund level). Secondary transactions may be structured as the sale of:

- LP interests in the "selling" fund(s);

- the AHC(s); and/or

- underlying loan and associated assets- with options two and three involving the establishment of a continuation fund vehicle.

The tax and practical implications of implementing option three are likely to be considerably more involved – especially if the transferring assets include loans which the "selling" fund(s) originated at par and are now distressed. It may well be necessary, however, to contend with the complexities of option three in order to execute a transaction tailored to transfer only certain assets to the continuation fund vehicle.

In connection with option three (and also, to some extent, option one and option two), detailed due diligence will be required in respect of underlying loan facilities agreements and associated finance documents – the scope of which could be significantly expanded by any equity component to a fund’s investment in a particular portfolio company. Even for inter-fund transfers, confidentiality provisions in favour, and a need to obtain the consent, of the borrower can pose problems to direct (and potentially also indirect or synthetic) transfers of participations in loans made as part of PE-driven leveraged financings – a major market for private credit. The structure and strategy of the "buying" continuation fund can matter to the contractual analysis.

An appropriate framework agreement for the sale and purchase of assets will be somewhat dependent on the homogeneity (or not) of the "portfolio" being sold. Transfer documentation will likely be granular and voluminous: depending on asset type, security and other credit support, jurisdiction and how assets are held by the "selling" fund(s). The mechanics and funds flow at closing should take account of any commitments to fund as well as outstanding loans and other investments (which raises the prospect of leveraging of the continuation fund – another interesting and developing area).

Success breeds success

Private credit continuation funds may come to add materially to the expanding line-up of fund secondary transactions, as GPs and LPs seek to adapt to changing market conditions and unlock value and liquidity from their investments. However, these transactions are not without their challenges, and will need to compare favourably to alternative approaches to realising (at least interim) liquidity if they are to gain traction. Potential (financing) alternatives include asset-backed leverage facilities made available to existing funds, collateralised fund obligations (CFOs) and a nascent secondary market in private credit loans.

Taken together, the raft of new liquidity solutions for private credit should be considered a broadly positive development that may catalyse even more primary investment in the asset class to fuel its further success.

This article first appeared in the December issue of Butterworths Journal of International Banking and Financial Law. This article is authored by Jamie Macpherson, Andrew Perkins, Henry Stewart-Brown, Samuel Brooks, and Sophie Donnithorne-Tait.

Get in touch