Take notice: giving notices under the JCT 2016 D&B Contract

The article assumes an unamended JCT Design & Build 2016 edition applies. Many of the other JCT forms have similar provisions, although you should always carefully check the terms of the particular contract in question.

General

How to send a notice

All notices must be in writing.

In general, the parties are free to agree the format and method of transmission of notices. If nothing is agreed, they may use any method to send notices as long as it is "effective". This includes using electronic means (such as email).

Under an unamended JCT Design & Build 2016 the exceptions to these general rules are termination notices and notices conferring third party rights or requesting warranties. These must be delivered by hand, or sent by Recorded Signed for or Special Delivery post. During various lockdowns and "work from home if you can" mandates, when offices have not been routinely occupied (particularly at the start of the pandemic), a practical work around has been to send these notices by email (so they are received by a person involved on the project who can take any required actions) and by hand, Recorded Signed for or Special Delivery post to comply with the contractual notice requirements.

Who and where to send a notice to

Notices sent by hand or by pre-paid post should be sent to the recipient’s address referred to in the Contract Particulars (if there is one) or to such other address as the recipient has notified to the sender. If neither of those addresses is current, notices should be sent to the last known principal business address or registered office of the intended recipient. Notices need to be addressed to the contract party but, other than that, they do not need to be addressed to a specific person.

If notices are being sent by e-mail, they should be sent to any agreed email address(es). If you intend to agree to receipt of notices served by the other party by email, it is a good idea to agree that the other party should send these to a group email address, or at least two different addresses, in case one of the recipients is not monitoring emails (because, for example, they are on holiday). You may wish to use the "read receipt" function when sending a notice by email – it can be helpful to be able to prove if and when the email has been read, although strictly it does not affect the question of whether or not the notice has been validly served.

If there is any doubt about the address to which, or method by which, a notice should be sent, it is always best to take the cautious approach and serve the notice to all addresses and by all methods which might arguably apply.

When will the notice be received (or deemed received)? And why does it matter?

Payment and termination notices both need to be received within particular time frames. In light of this, it is important to know when a notice has been received, or when it will be deemed to have been received, by the recipient.

Termination notices, and notices conferring third party rights or requesting warranties, which are posted will be deemed to have been received on the second "Business Day" after the date of posting, unless either party is able to prove the contrary (in which case it will be the date of actual receipt, if any). Only Mondays to Fridays which are not bank holidays count as Business Days. If served by hand, these notices will be deemed to have been received on the date they were delivered.

What about other notices, communications or documents (including payment and pay less notices)? If posted by Recorded Signed for or Special Delivery it will be deemed to have been delivered when it would ordinarily be delivered (even if it has not been) as long as it is not returned undelivered to the sender. Otherwise, it is the date when it is actually delivered. This is why, for payment notices and pay less notices, using email or personal delivery is helpful, as that gives the sender more control and visibility over the exact date and time of delivery.

Interim payment notices

There are key requirements around the timing and form of notices relating to interim payments, which parties must adhere to.

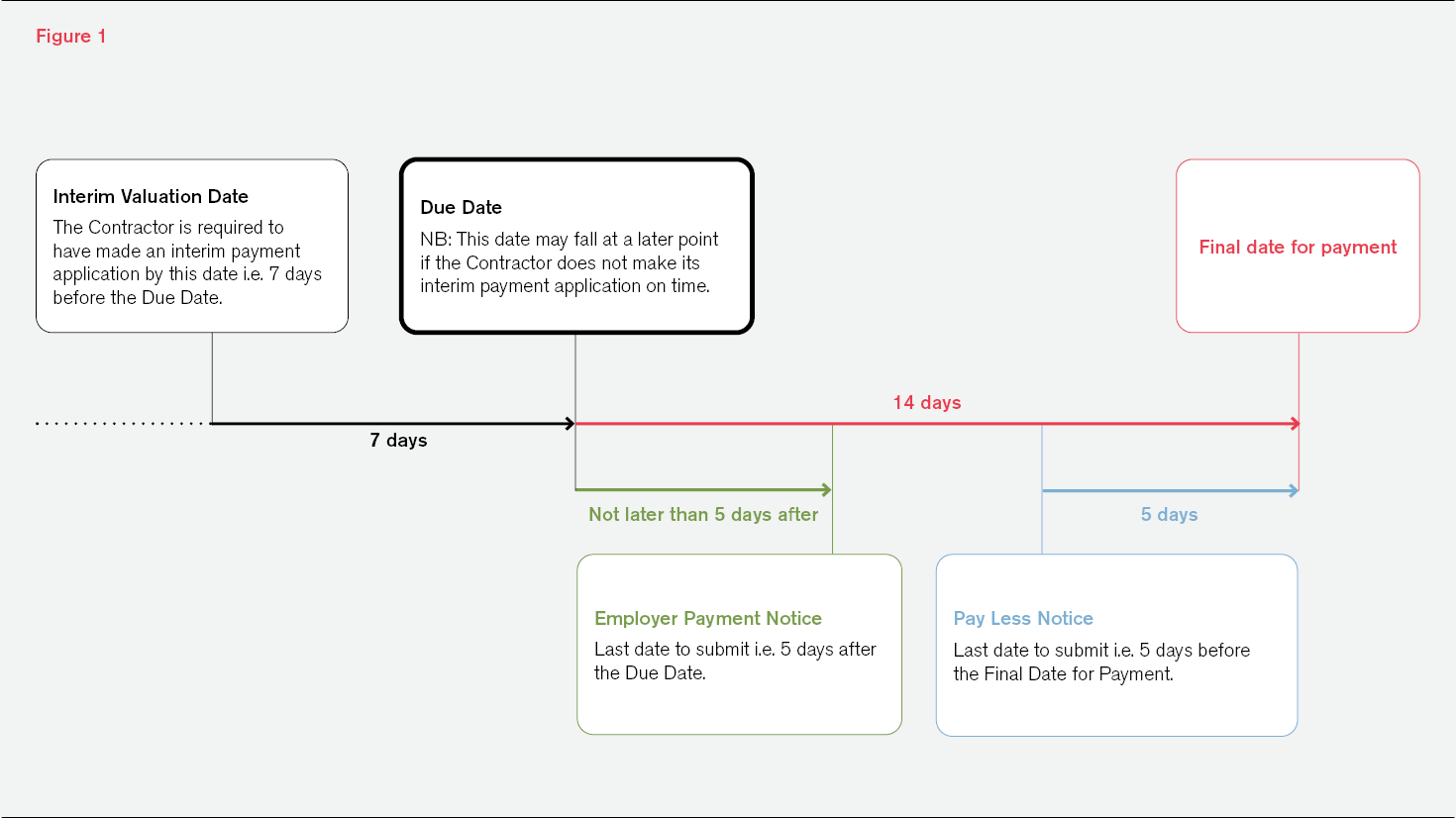

The diagram below summarises the key steps in the timeline that must be followed for these notices under the JCT D&B.

With this timeline in mind, in the rest of this section we consider some of the common pitfalls that can occur with interim payment notices, and how to avoid them.

Interim Valuation Date

The deadlines that apply to all JCT D&B interim payment notices are calculated from the Interim Valuation Date.

The first Interim Valuation Date is inserted by the parties in the Contract Particulars when they enter into the contract. After that, the Interim Valuation Date will be the same date each month, save for months where that date falls on a non-Business Day (i.e. a Saturday, Sunday or Bank Holiday). In those months, it will fall on the nearest Business Day in that month. One point to note is that, if the set date falls on a Saturday, the nearest Business Day will be the preceding Friday, and so the Interim Valuation Date for that month will be one day earlier. However, if the date falls on a Sunday, the nearest Business Day will be the Monday, and so the Interim Valuation Date will be one day later.

All of this means that, rather than always being a fixed calendar date, the Interim Valuation Date can move slightly in any given month. To deal with this, parties should carefully diarise in advance the exact Interim Valuation Date in every month.

Payment and Pay Less Notices

It is very important that Employer’s Payment Notices, and Pay Less Notices, are served on time, in the correct manner, and include the necessary information.

If this does not happen, the Employer will have to pay the amount stated as due in the Contractor’s Interim Payment Application.

Any challenge by the Employer to the Contractor’s assessment of the sum the Employer must pay will instead have to be made in an adjudication or in a subsequent interim payment "round". That can be a very significant problem for Employers, both for cashflow purposes and because it increases the risks to the Employer from the Contractor’s insolvency.

Calculating days

One point which can be particularly tricky is counting "days" when calculating deadlines. The starting point is that you count calendar days, not business days. So, for example, weekends count.

However, where the deadline arises from an act to be done a certain number of days "after" or "from" a specified date, public holidays (i.e. Christmas Day, Good Friday and bank holidays) do not count when counting days. This point applies, for example, to the deadline for the service of Payment Notices (which are due five days after the payment due date) but would not apply to the deadline for the service of Pay Less Notices (which are due five days before the final date for payment).

If there is any doubt, it is always best to take the cautious approach and serve the notice by the earliest date that might possibly apply.

Form and content

The Interim Payment Application, Payment Notice and Pay Less Notice all need to specify: (a) the sum which is said to be due; and (b) the basis on which that sum is calculated. If the Employer considers the sum due to be zero, they must still serve a notice which states this.

The courts have recently confirmed that payment notices do not need to set out in the notice itself the calculation of what is said to be due. Instead, it is acceptable for a notice to refer to a calculation that is set out in a separate document, including documents that have previously been provided to the receiving party. Care needs to be taken if a party does this, however – it is much easier for something to go wrong. For example, it may be unclear what previously provided document is being referred to.

We think the best approach for parties to adopt is to set out their calculations within the notice itself, or in documents enclosed with the notice, so that there can be no confusion. For example:

- if sending a hard copy notice, the calculations should be included in the same pack of documents, with clear reference made to them in the notice; or

- if sending a notice by email, all supporting documents should be attached to the same email by which the notice is provided.

Termination notices

Termination is another area where the timing for the service of notices is very important.

Imagine a party wishes to terminate the Contractor’s employment because of the other party’s default. To do so, two notices must be sent, in a specific order:

- first, a notice specifying the default must be served;

- the terminating party must then wait for 14 days from receipt of the first notice to see if the default continues;

- if it does continue, the terminating party may then terminate the Contractor’s employment by way of a second notice; and

- the second notice must be served at any point from the expiry of the 14 day period, up to 21 days after expiry.

If the notices are not served strictly in accordance with the timetable above, the termination will not be effective.

As previously mentioned, termination notices must be delivered by hand, or by Recorded Signed for or Special Delivery post. However, using the postal methods can significantly complicate matters. This is for two reasons:

- when served using the postal methods, the notice will be deemed to be received on the second "Business Day" after the date of posting. The deadlines above, however, are calculated by way of calendar days; and

- the rule on deemed service will not apply if the recipient can prove that the notice was received on a different date, or not at all. This can potentially cause significant uncertainty for the terminating party unless it has clear evidence of the date of actual receipt.

As a result, in our view, where possible a party should always deliver termination notices by hand, and good evidence should be kept of the delivery (including taking photographs of the property and the notice as served, if possible). This reduces any uncertainty about when notices are received, and reduces the possibility of the terminating party trying to terminate the contract before they are entitled to do so (and in doing so opening themselves up to a claim that they have themselves breached the contract).

Conclusion

Notice provisions and requirements are often overlooked but, as illustrated in this article, can be crucial.

This emphasises the importance of parties properly understanding what they have agreed regarding notices at the point they enter into their contract, and then making sure that they have the resources and systems in place to follow those provisions to the letter over the life of the contract.